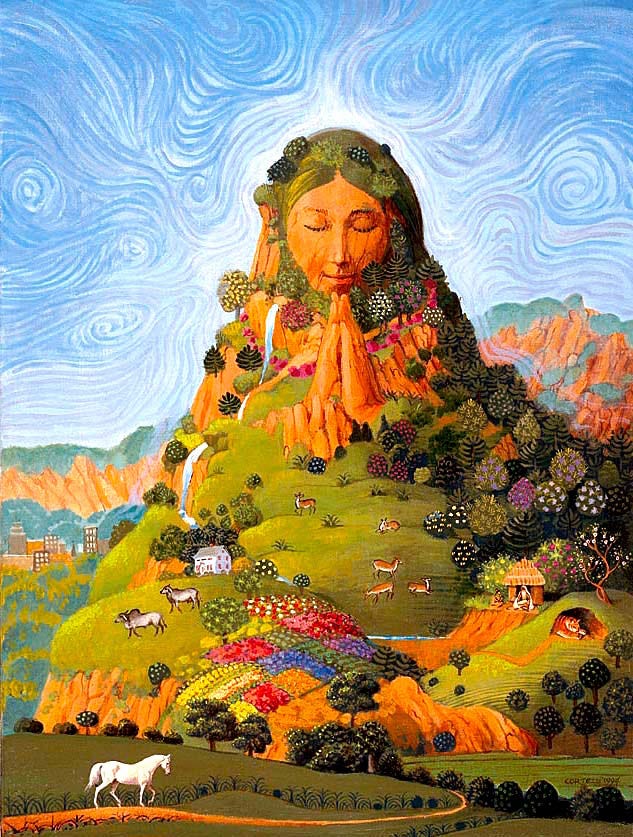

Women, Earth, and Economic Power

Women once enjoyed a special relationship to the land when nomadic tribes shifted to an agricultural way of life. Plants and children were gifts from the gods and woman was the medium for both. Women seemed to have the ability to summon ancestral spirits into her body, and cause fruits and grain to spring from planted fields. In a mystical sense, the earth belonged to the women and they had a religious and legal hold on the land and its fruits.

The human worldview has since moved from an awareness of the interconnectedness of all through the female to the individuality and separateness of individual beings which is the emphasis of the male principle. The male qualities of force, strength, drive, and individual self-determination led us out of the state of unity with nature that had come to have its own limitations.

Land no longer was held in common under the care of the women, but could be acquired by male conquest. Individual landholdings were justified under the Roman law concept of dominium which gave absolute power to the title-holder to control, use, and abuse.

As women's role in procreation was demystified, so were our ties to the earth cut. Under Roman law women were not generally allowed to own land; currently women own less than 1% of the world's resources.

Ending this age of militarism and environmental rape requires that the male and female forces find a new balance and harmony. Neither nature as the "omnipotent" nor the superiority of individual human beings dominating nature can be a legitimate worldview. We need to affirm the human species as partner with nature.

The biological nature of the mother/infant bond places the responsibilities of childrearing primarily upon women. People now attain less than their full potential because as children they are not given the right kind of stimuli and guidance at the proper moments in their neurological development. The first five years of a child's life require great amounts of love, attention, and skill.

The majority of mothers are now wage-earners as well. They are caught, along with men, in a web of economic injustice in which their wage earnings buy less of the basic needs each year.

This injustice stems from the Western land tenure system that has led to the ownership and control of the earth by a small number of people. This in turn is rooted in a deeply ingrained metaphysical error in Western civilization which sees human beings and the earth as distinctly separate systems.

The various equal rights movements have yet to affirm the most essential right of all -- the equal right of all people to the earth. This is the "equal right" that furthers human unity and acknowledges our interconnectedness not only with each other but with the earth from which we come and to which we return.

Equal rights to the earth can be practically attained through a ground rent system whereby the community created value of land and resources is collected in lieu of other taxes.

The German economist Sylvio Gisell proposed that ground rent be the source of payments for the support of women in the role of mothers and homemakers. Thus, ground rent payments would be an equivalent to the use of the soil by primitive women. As he put it,

Every woman could bring up her children without being forced to depend on the financial support of a man. Economic considerations would no longer be able to crush the spirit out of women. A woman would be free to consider the mental, physical, and race-improving qualities and not merely the money-bags of her mate.

By placing the economic infrastructure on a base of essential fairness, people as wage-earners would reap the full rewards of their labor to the advantage of both women and men of all races. This fundamental reform will facilitate the procuring of other rights and advances needed for human/planetary progress and evolution.

Find out more here where you are welcome to join our worldwide movement to implement the tax shift to commons rent aka land value tax public finance : https://theiu.or

g

Discussion about this post

No posts

Dorota - quite strange that you commented on my substack in reply to what I wrote regarding Robert Malone. Good for you, you did make it through hard work. I also know there are many people working hard who cannot find affordable housing. Land and thus housing costs in most areas go up faster than wages - the Law of Rent. Keep learning, read my book here: https://theiu.org/books/

Socially Just Taxation and Its 17 Effects

Consider how land becomes valuable. New settlers in a region occupy the land for use. The central land is most valuable, due to its convenience and least transport need. This distributed value of land is created by the community and is not simply due to the natural resources. As the village and city expand, speculators in land values deliberately hold potentially useful sites out of use until planning and development have caused their site-values to grow. Meanwhile there is competition for access to the most suitable sites for housing, agriculture and manufacturing industries. The limited availability of the most useful land means that the rents paid by tenants make their residences more costly and the provision of goods and services more expensive. It also creates unemployment when entrepreneurs find the rents or transport costs too high for them to operate. This situation allows wages to be lowered by the monopolists, who are also or control the producers and whose land was obtained when it was cheap. This basic structure of our social system limits opportunity and creates poverty.

The most basic cause of our continuing poverty is the lack of employment and properly paid work due to the lack of opportunity of access rights to the land on which the work is done. The useful land is monopolized by a landlord who either holds it out of use (for speculation in its rising value), or charges the tenant heavily in rent for its access right. Its produce becomes more costly than what an entrepreneur would charge, were he/she able to compete on an equal basis. When the landlord is the producer, he/she has control of the land and price of its produce.

A wise and sensible government would recognize that this problem derives from the lack of opportunity to work and earn. It can be solved by the use of a tax system which encourages the proper use of land and which stops penalizing almost everybody else. Such a tax system was proposed by Henry George, a (North) American economist, but somehow most macroeconomists seem never to have heard of him in common with a whole lot of other administrators. In “Progress and Poverty” 1879, Henry George proposed a single tax on land values without other kinds of tax on produce, services, capital gains, etc. This regime of land value tax (LVT) has 17 features of benefit everyone in the economy, except for landlords, tax collectors and banks, who find that land dominance has its own rewards.

17 Aspects of LVT Affecting Government, Land Owners, Communities and Ethics

Four Aspects for Government:

1. LVT, adds to the national income as do all other taxation systems, but it can and should replace them.

2. Tax avoidance becomes impossible because the sites are visible and the cost of collecting LVT is less than for production-related taxes.

3. Consumers pay less for their purchases due to lower production costs (see below). This creates greater satisfaction with the government’s management of national affairs.

4. The national economy stabilizes—it no longer experiences the 18-year business boom/bust cycle, due to periodic speculation in land values (see below).

Six Aspects Affecting Land Owners:

5. LVT is progressive--owners of the most potentially productive sites pay the most tax.

6. The land owner pays his LVT regardless of how his site is used. When fully developed, a large proportion of the ground-rent from tenants becomes the LVT, with the result that land has less sales-value but a significant rental-value (even when it is not being used).

7. LVT stops speculation in land prices--withholding of land from proper use is not worthwhile.

8. The introduction of LVT initially reduces the sales price of sites, (although their rental value grows over long-term use).

9. With LVT, land owners are unable to pass the tax on to their tenants as rent hikes, due to the reduced competition for access to additional sites that come into use.

10. With LVT, land prices will initially drop. Speculators in land values will want to foreclose on mortgages and withdraw their money for reinvestment. Therefore, LVT should be introduced gradually to allow sufficient time to transfer for re-investment in company-shares etc., and to simultaneously meet the increased demand for produce (see below).

Three Aspects Regarding Communities:

11. With LVT, there is an incentive to use land for production or residence, rather than it being unused. As more sites become available, the competition for them becomes less fierce so entrepreneurs are more active.

12. With LVT, greater working opportunities exist due to cheaper land and a greater number of available sites. Consumer goods become cheaper too, because entrepreneurs have less difficulty in starting-up their businesses and because they pay less ground-rent--demand grows whilst unemployment decreases.

13. Investment money is withdrawn from land and placed in durable capital goods. This means more advances in technology and cheaper produce too.

Four Aspects About Ethics:

14. The collection of taxes from productive effort and commerce is socially unjust. LVT replaces this extortion by gathering the surplus rental income, which comes without any exertion from the landowner or by the banks--LVT is a natural system of national income-gathering.

15. Bribery and corruption on information about developments in land cease. Before, this was due to the leaking of news of municipal plans for housing and industrial growth, causing shock-waves in local land prices (and municipal workers' and lawyers’ bank balances).

16. The improved and proper use of the more central land reduces the environmental damage due to a) unused sites being dumping-grounds, and b) the smaller amount of fossil-fuel use, when traveling between home and workplace.

17. Because the LVT eliminates the advantage that landlords currently hold over our society, LVT provides a greater equality of opportunity to earn a living. Entrepreneurs can operate in a natural way-- to provide more jobs. Then earnings will correspond to the value that labor puts into the product or service. Consequently, after LVT has been properly introduced it will eliminate poverty and improve business ethics.